Sales of Indian-made tractors in January 2025 were up 11.31% compared to January last year. The 61,875 tractors sold were nearly 6,300 more than the 55,589 units sold in 2024. It is a graphic expression of the positive trend of growth in the tractor industry and anecdotal proof that despite some difficult brands. Please see the subject report for January 2025, which includes brand-wise numbers and further details.

KhetiGaadi always provides right tractor information

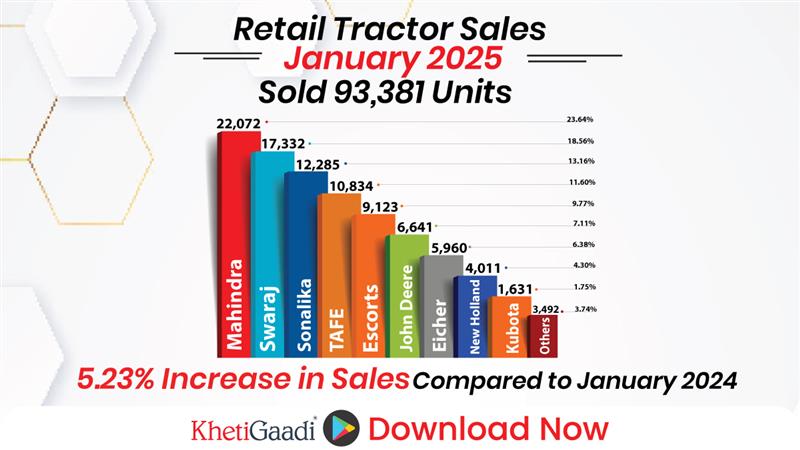

FADA Tractor Sales Report 2024—Brand-Wise Analysis

Brand Wise India’s leading tractor manufacturer, the M&M Group, in India, sold 26,305 tractors in January 2025, showing a truly remarkable increase of 14.51% over the 22,972 sold in January 2004 (the previous year). During this period their market share increased by 1.19%, also pointing to the strength of M&M’s presence in markets and their successful strategic development.

Though TAFE Group still saw moderate growth in sales, meanwhile increasing only slightly in the market with 10,709 tractors sold in January of 2025—a 13.29% rise from the 9,453 units sold at that time last year. But it drove a 0.30% upsurge for **, highlighting the dual performance of the mixed market.

Sonalika’s sales were 8,027 tractors in January of 2025, a strong 12.14% increase from the 7,158 units sold at that time last year. In addition, the company saw its market share grow slightly—by 0.10%, rivaling **.

John Deere saw impressive growth, selling 6,436 tractors in January 2025—up 18.01% from the 5,454 machines it had sold in January four years before. The brand’s market share increased by 0.59%, revealing a successful strategy and rising demand for its tractors.

In Jan 2025, Escorts Kubota sold 6,058 tractors. This was down 10.68% from the 6,782 units sold during Jan 2024. Correspondingly, their market share plummeted by 2.41%, indicating difficulty as the brand of a renewal competitive position.

New Holland sold 2,905 tractors in Jan 2025, a solid 38.00% improvement over the 2,105 units sold in Jan 2024. Though the company’s market share increased by 0.91%, it also shows that it is doing quite well.

In Jan 2025, reported sales by Preet of 346 tractors represented a 13.93% decrease as compared to the 402 units sold during Jan 2024. The report also reveals a statistical downtrend in market share of only 0.16%, suggesting steady yet tough market performance.

In January 2025, Indo Farm sold 316 tractors, a 19.39% drop from Jan 2024’s 392 units. Growth in sales and market share slid, presaging intense competition for multinational Finnish producer VST Corporation, which had 528 sold last month. They account for this point of gray as this year’s year—Da Hongfei days (this is likely also to be the only seasonable economic results released this year).

In January 2025, VST sold 259 tractors, 4.44% more than the 248 units sold in Jan 2024. Market share was down slightly by 0.03%.

Captain Tractor sold 240 vehicles in Jan 2025. This is 33.15% less than the 359 units sold in Jan 2024. Their market share dropped by 0.26% from a year ago, the second consecutive year of decline.

In January 2025, 207 tractors were sold by ACE, down 10.39% from the previous year. This figure also represents a significant decrease of 24 units compared to January 2024.

In addition, their market share also experienced something of a dent, dropping 0.08% over a single month.

SDF sold an impressive 67 tractors in Jan 2025, marking a huge 103.03% increase from the 33 units sold back in Jan 2024. Even so, there is little growth in market share, only a meager 0.05%.

Stay connected to the KhetiGaadi WhatsApp channel and get the latest updates on farming innovations and government schemes. Visit KhetiGaadi for more information and guidance.

Contact Khetigaadi for guidance and updates on agriculture schemes for farmers:

Phone: 07875114466

Email: connect@khetigaadi.com

To know more about tractor price contact to our executive